…LCCI tasks CBN on foreign exchange policy

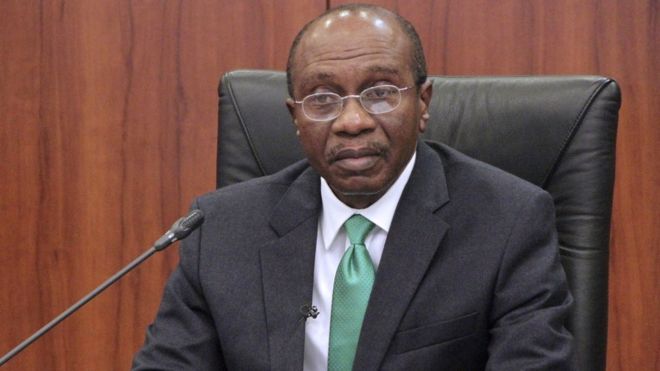

The Central Bank of Nigeria, CBN, has retained lending rate at 11.5 per cent. The CBN Governor, Godwin Emefiele, disclosed this after the committee’s two-day meeting in Abuja on Tuesday.

It also retained the Cash Reserve Ratio and Liquidity Ratio at 27.5 per cent and 30 per cent respectively.

The CBN governor explained that members of the MPC were of the view that given that the exit of the country from recession was fragile, any decision to tighten may reverse the fragile recovery and return the country back to recession.

In the light of this, he said, the concession among the MPC members was that given that the inflation was substantially a supply side factor, there was need to continue to focus on consolidation of recovery process by taking those actions that would continue to stimulate output growth, create employment.

He added that at the same time, it must have an eye on efforts to moderate inflationary pressure using the current administrative measures being adopted by the bank in controlling

Reacting to this decision, the Director General, Lagos Chamber of Commerce and Industry, LCCI, Muda Yusuf, said the Lagos Chamber of Commerce and Industry notes the decision of the Monetary Policy Committee of the Central Bank of Nigeria to retain policy parameters during its March 2021 meeting with Monetary Policy Rate [MPR] at 11.5%; Cash Reserve Ratio [CRR] at 27.5%; and Liquidity Ratio at 30%.

The LCCI according to him appreciates the dilemma which the current stagflation condition presents to the monetary authorities. We note the imperative of striking a balance between stimulating output growth and curbing intensifying inflationary pressures.

Considering recent macro developments in the economy, he said, holding policy stance seems to be most appropriate decision at this moment.

“The CBN Governor stated at the briefing that the bank’s current policy focus anchors on boosting output growth given the fact that the domestic economy narrowly exited recession in the fourth quarter of 2020. We believe sustained intervention efforts of the Bank would further enhance credit flows to the real economy, stimulate output growth and ultimately moderate inflationary pressures. With unemployment rate at a record high of 33.3% and weak employment levels in manufacturing and services sector, tightening monetary policy stance would stifle access to credit, and undermine the pro-growth agenda of the CBN”, he said.

Headline inflation rose by 17.33% in February 2021, the highest price level since March 2017. As we have stated in our previous position papers, consumer prices are currently being driven by cost-push factors including heightened insecurity resulting in persistent decline in agricultural output; foreign exchange illiquidity, exchange rate depreciation, higher energy prices and upward adjustment of electricity tariffs, which are beyond the control of monetary authority. We endorse the position of the MPC on need for fiscal authorities to expedite actions in addressing these challenges and other investment climate issues constraining the supply side of the economy and fuelling inflationary pressures.

“We request that the MPC gives more attention in its deliberations to the foreign exchange policy because of its profound implications for economic performance and the confidence of investors. The forex policies are as important as liquidity management concerns. Foreign exchange framework is key to the price stability mandate of the CBN. The Chamber notes with concern the divergent positions of both the fiscal and monetary authorities on the country’s foreign exchange policy framework. It is important for the fiscal authorities, CBN and Economic Advisory Council to be on the same page as far as the country’s foreign exchange policy framework is concerned. This lack of coherence among policymakers sends a negative signal to the investment community, aggravates uncertainty and undermine the confidence of investors”, stated the DG.