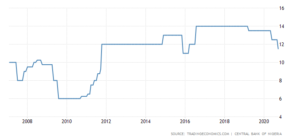

The Nigerian Banking system has been through two major asset quality crisis in the past twelve years: i) the 2009-12 margin loan crisis, which resulted in the sector NPL ratio spiking from 6.3% in 2008 to 27.6% in 2009; and ii) the 2014-18 oil price crash crisis, which resulted in the NPL ratio spiking from 2.3% in 2014 to 14.0% in 2016. Within our coverage universe of banks, the NPL ratio spiked from an average of 6.1% in FY08 to 10.8% in FY09 and from 2.6% in FY14 to 9.1% in FY16.

This is contained in a report released by EFGHermes, a leading financial services corporation.

“During both cycles, we estimate that the banks wrote-off between 10-12% of their loan book in constant currency terms. Given the potential macroeconomic shock (real GDP is expected to contract by 4%, NGN/USD exchange rate is expected to devalue to a range of 420-450, oil export revenue is expected to drop by up to 50% in 2020. We think the risk of another significant NPL cycle is high”, said the Financial Services Corporation.

It will be recalled that the Central Banks of Nigeria sanctioned deposit money banks several times this year, which is believed that the deductions are weakening the banks’ ability to play their critical role for the much-desired recovery of the nation’s economy from the hits of a combination of the novel Coronavirus (Covid-19) pandemic and global oil price crash.

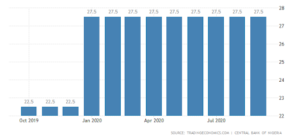

Since April this year, commercial banks in Nigeria have been under the heavy radar of the CBN over compliance to the 27.5 percent CRR target.

The apex bank withdrew a total of N118 billion from the accounts of about 20 banks over alleged default. Before then, it had debited the banks to the tune of N2.144 trillion between April and June.

The policymakers of the apex bank had in January tweaked the monetary policy instrument (CRR) for the first time in about four years by 500 basis points, to 27.5 percent from 25.5 percent.

The CRR is a mandatory part of a bank’s total deposit, expressed in percentage, which a bank must maintain with the apex bank at all times and subject to change at the discretion of the regulator. By the decision, banks are now left with a low level of funds to the tune of the new CRR, as the amount available for disbursement in the form of loans.

The CBN Governor, Godwin Emefiele, had admitted that the move was part of efforts to curb excess liquidity in the banking system, already adjudged as a contributor to the resurging inflation trend and pressure on the naira, which has been devalued twice this year from N306 to N380 to the dollar in a bid to unify the market rates.

The World Banks frowned at this few months ago, accusing the Apex Bank of Nigeria of punishing Deposit Money Banks in Nigeria instead of encouraging them to grow.

Experts are of the view that the Central Bank should therefore ensure that the commercial banks operate in a conducive environment that will engender growth in the banking industry and the return on investments of their shareholders.

“Moreover, these risks have been compounded by the CBN’s policies over the past five years, which have eroded the underlying profitability of the sector and made the banks more vulnerable to the current environment. Given the numerous uncertainties (the pandemic, macroeconomic trajectory, and regulatory response), we have modeled three different asset-quality scenarios for our banks, which in turn have differing implications for the banks’ capital adequacy, growth rates, and profitability”, stressed the report.

“Based on the assumptions, the report estimated that the banks will write-off c.12.3% of their loan books in constant currency terms between FY20-22e, which is moderately higher than the average of 11.3% written-off during the previous two NPL cycles”.

“Under this scenario, it is estimated that the ROE of our banks will plunge from an average of 21.8% in FY19 to 7.9% in FY20e and 7.7% in FY21e before recovering to 18.1% in FY24e.

“Given that magnitude of the macro-economic shock looks to be significantly larger than the previous two NPL cycles, there is a very high probability that asset quality deterioration, for our universe of banks, could be more severe this time around. In a pessimistic scenario (40% probability), it is assumed that the average NPL ratio rises from 6.4% in FY19 to 11.8% in FY20e and 10.0% in FY21e before moderating to 4.9% by FY24e. It is estimated that the average cost of risk for our banks will peak at 10% in FY20e and FY21e, fall to 5.0% in FY22e, before moderating from FY23e onwards”, stated the report.

Under this scenario, the report expected the banks to write off c.26.6% of their loan books in constant currency terms over the next three years. Under this scenario, the average ROE of our banks would drop to -8.8% in FY20e, -21.4% in FY21e, and -2.9% in FY22e, before increasing to 19.7% by FY24e.

If the pandemic ebbs away and macro-economic activity rebounds rapidly, there might be a possibility that the deterioration in credit quality will be far less pronounced. Thus, in optimistic scenario (5% probability), it is assumed that the average NPL ratio of our banks would increase from 6.4% in FY19 to 6.8% in FY20e and moderate to 4.8% by FY24e.

Under this scenario, it is estimated that the average cost of risk will spike to 4.2% in FY20e before easing to 2.4% in FY21e and average 0.9% thereafter through the rest of the forecast period.

Under this scenario, it is further estimated that the average ROE will drop to 11.6% in FY20e before recovering to 14.4% in FY21e and 19.0% by FY24e.

This story was supported by the US Embassy via the ATUPA fellowship by Civic Hive