… USD 3.7 trillion expected to be invested in EV infrastructure between 2018 and 2030 alone.

The Nigerian Energy Support Programme, NESP, has been in the forefront of Electric Vehicles revolution called E-Mobility and Rural Electrification through Renewable Energy in Africa.

It aims to foster investments in Renewable Energy, Energy Efficiency and Rural Electrification and Electric Vehicles in the African Region. To this end, NESP recently launched Electric Vehicles in Lagos called E-Mobility.

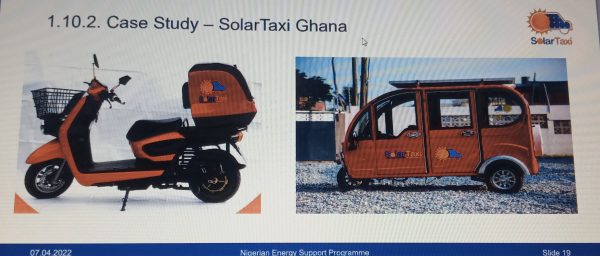

NESP has introduced the e-Mobility and Rural Electrification through Renewable Energy in Uganda, Kenya, Ghana and Nigeria to mention but a few.

The Nigerian Energy Support Programme, NESP, is a technical assistance programme, co-funded by the European Union and the German Federal Ministry for Economic Cooperation and Development, BMZ, and implemented by the Deutsche Gesellschaft für Internationale Zusammenarbeit, GIZ, in collaboration with the Federal Ministry of Power.

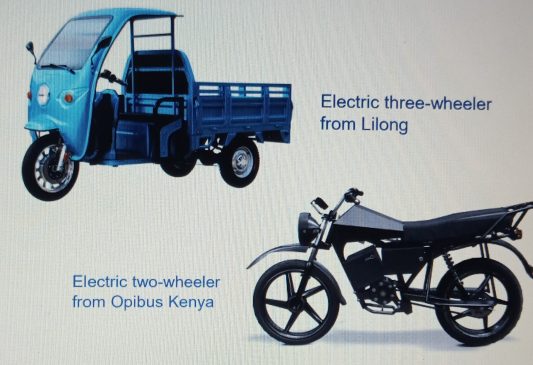

“Putting electric vehicles into context, E-Mobility has the potential to transform infrastructure development and logistics globally and in Sub-Saharan Africa. Electrification of mobility reduces oil dependency and pollution and offers energy savings compared to combustion vehicles. Electric vehicles, EVs, within the context of this project predominantly comprise electric two-wheelers, E2Ws, and electric three-wheelers”, said NESP.

“Electric vehicles generate multiple benefits as transport-related CO2 emissions have risen by 200% between 1990 and 2016 in non-OECD countries and are expected to grow by 2% annually 2. 91% of 4.2M premature deaths caused by outdoor air pollution are in low and middle-income countries. Sub-Saharan Africa currently hosts the vast majority of the one billion people without access to transport and dependence on petrol and diesel for mobility”, added NESP.

NESP listed benefits generated by electric vehicles to include positive impacts on climate change and the environment; “Electric vehicles (..) offer the largest decarbonisation potential for (..) transport. Improvements in health through reduction in air pollution, improved accessibility to transport solutions and reduction of dependence on fuel.

The Electric Vehicles “revolution” is well underway

The EU and the US aim for an EV share of at least 50% by 2030; EU, US and China are expected to ban combustion engine sales by 2030 2. Sales for EV adoption accelerated in major markets despite COVID-19 3. USD 3.7 trillion expected to be invested in EV infrastructure between 2018 and 2030 alone. Adoption of EVs will disrupt many industries, incl. battery production, fuel supply and infrastructure.

E2Ws and E3Ws have significant potential. Owing to the limited lifespan of E2Ws and E3Ws, vehicle turnover is very rapid, allowing for a quick introduction of new technologies. McKinsey has estimated that global sales of E2Ws and E3Ws could reach $150bn this year. Surge in popularity since COVID–19 – Customers avoiding transport with multiple people and 90% of all two-wheelers are for commercial use, resulting in high operating costs.

Factors driving electrification of mobility

Environmentally friendly regulations and incentives, e.g. ban of combustion engine, ICE, sales, subsidies and tax incentives for Electric Vehicles. Lower total costs of ownership than for combustion engine vehicles – Electric E2Ws 25% cheaper over lifetime. Emergence of innovative goto-market models, e.g. Battery-as-a-service.

EV adoption is further spurred by falling prices of equipment from 2010 – 2019, there have been (…) decreases in the unit costs of solar (85%), wind energy (55%), and lithium-ion batteries (85%), and large increases in their deployment: >10x for solar and >100x for EVs“ – IPCC Report 2022 2. Battery prices expected to half again in a few years.

Challenges

Current barriers to electric mobility include lack of data and literature for electric mobility still prevalent, though situation improving. Financing mandates at times restricted to specific sectors (e.g. energy OR transport), however important to consider that e-mobility has cross-sectoral impacts and benefits.

Unveiling Electric Vehicles, EV, in Rural and Peri-Urban Communities.

Investment gap of private investment in transport sector required to meet SDGs in amounts to approximate USD 250bn annually. Success of entrepreneur-led solutions in e-mobility is highly dependent on public infrastructure development, particularly in electricity access and reliability. Some governments lack legally binding, long-term mobility targets; Legal and regulatory frameworks are not always consistent and sustainable. Customers still having “range anxiety“ and facing high up-front costs.

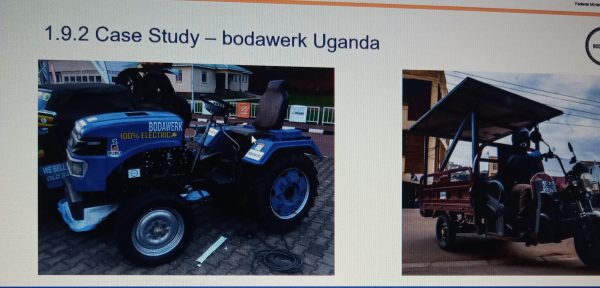

Product: Li-Ion battery (new and recycled). Electric motorcycles, outboards. Solar systems and IoT Battery Management.

Scope of activities /processes

RnD & Prototyping, production, distribution, sales and after-sales.

Involvement in Rural Areas

Driving rural electrification with 2nd life batteries and Agriculture project with electric tractors.

Market operation

Main Market: Uganda 2. Exports to Kenya.

Scaling Strategy: Local mass production, direct to consumer sales and consumer financing.

Market Potential

Sub Saharan Africa and developing countries.

Followed by case study Ghana. Pic of two tractors here.

Enabling environment for EVs in Nigeria

The government plans to incorporate EVs in National Automotive Industry Development Plan, NAIDP, increased drive to produce vehicles locally, incl. development of infrastructure and standards, by potential introduction of tax holiday for vehicle manufacturing companies and zero duty and levies. First EVs already being produced in Nigeria, and first charging stations. NADDC posits that 50% of vehicles on Nigeria‘s roads will be electric by 2031.

The time is right to introduce electric vehicles in rural areas of Nigeria

Battery prices have fallen 87% from over $1,100/kWh in 2010 to $137/kWh in 2021. The number of EV models is rising, with 400+ new models expected by 2022 globally, 3 to 4 million electric E2Ws expected to be sold in Nigeria by 2040 every year 3. Electric vehicles have lower O&M requirements than combustion-engine vehicles due to less moving parts. Close to 50% of Nigeria‘s population is rural, with transportation representing a lifeline for economic and agricultural livelihood. Alternative mobility solutions that improve transportation and make the transport of goods outside of rural communities more cost-effective can ultimately result in income growth for the community.

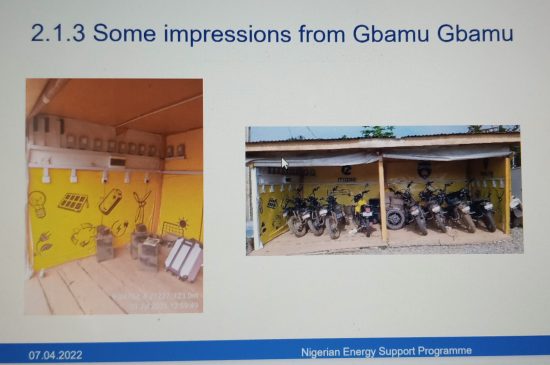

Introduction MAXRubitec EV Pilot

MAX deployed 10 electric motorbikes in a mini-grid in Gbamu Gbamu run by Rubitec in mid-2020. NESP has monitored the implementation of the pilot, conducting a survey of the project in November 2020 and an updated survey in July 2021. The motorbike models on site have either been upgraded or replaced by more powerful bikes, with the newly developed M3 model to be deployed shortly.

Business Model deployed in pilot

Mini-Grid Developer, sales of electricity, Max Transport Business

MAX (Transport business) Renting out electric motorbikes at NGN 1,000 per day (NGN 500 per battery swap)

Some impressions from Gbamu Gbamu

Benefits of EV charging for mini-grid developers

EV charging presents a favorable load as it happens in the morning and middle of the day, when electricity production is cheapest. Charging pattern can be flexibly adjusted in collaboration with EV Company. EV load is highly predictable, with relatively little variation within a week and over seasons. Commercial contract with company deploying EVs may result in longterm partnership at large number of sites.

Lessons Learnt from the pilot

Uptake of EVs is increasing with awareness, time and availability. Pricing is key: Setting an affordable price point makes EV motorbike renting attractive compared to combustion engines. The quality of roads impacts usage: Best deployed in areas with reasonable road quality. Consumer patterns in rural areas differ from more connected areas: Rural customers tend to want to overload bikes with passengers and goods, therefore less remote areas favourable. Additional battery swap stations could enhance range: Deployable at mini-grids in clusters. Addition of EVs to mini-grids can boost consumption reliably, with high growth potential.

The Nigerian mini-grid market

The Rural Energy Agency, REA, estimates a total market potential of 10,000 mini-grids in Nigeria. To date, around 100 mini-grids have been installed in Nigeria, with concrete plans for further scale-up. The REA‘s Minimum Subsidy Tender, MST, aims to electrify 250 communities, 200,000+ connections (200+ mini-grids) are to be realised through the REA‘s Performance-Based Grant, PBG, program. Approximately 23 interconnected mini-grids are currently under development by NESP‘s, MAS program There is a strong presence of both domestic and international mini-grid developers in Nigeria. Nigeria boasts one of the most advanced policy and regulatory frameworks for mini-grids globally.

The potential for EVs within mini-grids

Two-wheel EVs may be deployed at virtually any mini-grid: All mini-grids are deployed in regions in which motorbikes are the main method of transport. The demand curve of EVs is particularly suitable for solar mini-grids. Only mini-grids with very bad road networks and/or economic potential ought to be excluded. If we conservatively assume that only 50% of all 10,000 mini-grids to be deployed will incorporate 20 EVs per site, there is a potential for 100,000 EVs to be deployed at mini-grids. The “lowest-hanging fruit“ for EV deployment in mini-grids are interconnected mini-grids, with their better economy and typically better road access compared to isolated mini-grids. Impact investments in particular may provide a key catalytic role to spur progress in the sector.

Potential business models for deployment of EVs in minigrids

Fully integrated into MG Company, MG Developer owns and operates EVs. Customers pay rental fee directly to MG Developer. Service done by MG Developer with support of EV manufacture,

Partnership

EVs owned, operated and serviced by EV Company. EV Company receives electricity by MG developer and customers pay EV Company directly.

MG as facilitator only

EV manufacturer sells EVs to local owners. Local owners may charge Evs at mini-grids and service done by third-party service provider.

Next steps for deployment of EVs in Nigeria

“NESP plans to continue promoting the utilisation and adoption of electric vehicles in Nigerian mini-grids. Assisting to public bodies for the adoption of favourable regulations and framewoks. The adoption of standards for batteries, also for electric vehicles. Innovation in local production and supply chains. Linkage of financiers with e-mobility companies and mini-grids, as well as Technical Due Diligence. Interested mini-grid developers and e-mobility companies may reach out to NESP for further discussions and potential provision of technical assistance”, NESP assured.