The Nigeria Deposit Insurance Corporation, NDIC, has been collaborating with the Central Bank of Nigeria, CBN, to ensure that all Nigerians are brought into the banking system with the aim of achieving the goal of Financial Inclusion in Nigeria.

The Director, Insurance & Surveillance Department, NDIC, Galadima Gana, stated this at the 2021 NDIC, FICAN workshop with the theme: The Role of Deposit Insurance System in Promoting Financial Inclusion” held in Gombe, Gombe State.

“The NDIC had been collaborating with the Central Bank of Nigeria, CBN, in various capacities. As a member of the Bankers’ Committee, the NDIC is fully involved in the formulating and promoting financial inclusion policies in the country. NDIC has membership in all the 3 Committees (Steering, Technical and Working Group). The Managing Director/CEO of the NDIC is a member of the Steering Committee. The Steering Committee is responsible for policy formulation; setting of vision, mission, broad objectives and targets, monitoring of implementation, as well as escalation of major challenges to the presidency (National Economic Council) for intervention, if and when necessary”, he said.

“The NDIC, as part of the Safety-Net arrangement in Nigeria and a Stakeholder in the Financial Inclusion Strategy of the Government, recognises the importance of Financial Inclusion in reducing the number of adult Nigerians that do not have access to financial services. It is generally believed that ‘‘Deposit insurance promotes financial inclusion by bolstering confidence in financial institutions and potentially leading to greater savings among the poor. Access to deposit insurance should provide a measure of protection to small savers, provided they are informed about safe places to store their money. Involvement of Deposit Insurer in financial inclusion typically takes the form of financial education and outreach activities designed to ensure that depositors are informed about safe methods of storing their money in the mainstream banking sector”, he noted.

“There is a general consensus that financial inclusion is a catalyst for economic growth and development and equally regarded as a right of all citizens as it promotes better quality of life and also a tool for boosting the economic capacity and capabilities of the poor. Access to financial services affords several benefits to the households and consumers and the economy at large because resources are channeled to the productive sectors. However, factors such as Age, Gender, Education, Irregular Income, Locations etc. are basically known to inhibit financial inclusion and therefore must be effectively tackled by relevant authorities to achieve notable access to financial services by majority of the unbanked”, the Director stated.

Financial inclusion according to him is an essential component of a country’s poverty alleviation strategy which when fully implemented would lead to reduction in poverty and inequality.

Financial inclusion is not synonymous with microfinance, rather it embraces all providers of financial services including deposit money banks, capital market, insurance, pension and other financial services providers

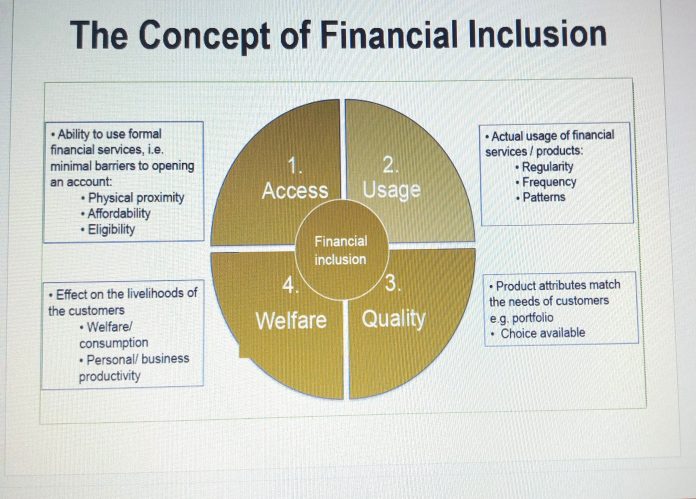

“The Centre for Financial Inclusion (Washington DC, USA) defines financial inclusion as “the provision of access to a full suite of quality financial services, at affordable prices, in a convenient manner, and with dignity for the clients. It is a state where financial services are delivered by a range of providers, mostly private sector, and reach everyone who can use them, including the poor, disabled, rural, and other excluded populations”

“It may also be regarded as a situation which allows for ease of access to, or availability of and usage of formal financial systems by members of the public.

“It is similarly described as a process where all members of an economy do not have difficulty in opening bank account; can afford to access credit; and can conveniently, easily and consistently use financial system products and facilities without difficulty. On the other hand financial exclusion signifies lack of access by certain segments of the society to appropriate, low cost, fair and safe financial products and services from mainstream providers. This is basically due to being predominantly residing in rural areas, having low or no education and low unavailable access to points offering financial services”, he stressed.

“The National Financial Inclusion Strategy, FIS, of the Federal Government was launched on 23rd October, 2012. The CBN is the lead promoter of the strategy, with a dedicated Secretariat to coordinate effective implementation. The Strategy was revised in June 2018”, he pointed out.

He listed the following Strategic Objectives the FIS seeks to achieve to include: Set a clear agenda to significantly increase access to and use of financial services by 2020; Ensure that the concerns and inputs of all stakeholders are considered and that roles and responsibilities are defined before financial inclusion regulations and policies are established; and Formulate a framework for increasing the formal use of financial services from 36.3% of the adult population in 2010 to 70% by 2020.

The Director noted that the Government formulates an appropriate strategy at the national level, which are translated into implementable policies. For example the National Financial Inclusion Strategy, NFIS, 2020, create an enabling environment – macroeconomic stability, ensure provision of adequate infrastructure including roads, telecommunication coverage and provision of electricity.

The Financial Sector Regulators according to him are the implementing agencies such as the CBN, NDIC, PENCOM, NAICOM and SEC. The CBN is major promoter of the Strategy and warehouses the Secretariat. Consumer education to promote financial literacy. The Financial Institutions made up of banks, insurance companies, Pension Funds, Capital market players, other providers of financial services; Telecommunication and Technology companies as facilitators; The non-bank formal/informal financial services providers, Fintechs, – moneylenders and Cooperatives Societies, MMOs.

Speaking further on Consumer Protection, he said, “For confidence to be instilled in the minds of the target unbanked, the issue of Consumer Protection, Data Risks and Opportunities need to be put in front burner. There should be an effective way of identifying innovative solutions for managing risks and opportunities associated with digital finance and customer data. Gender inequality should also be looked into to remove barriers inhibiting women from accessing financial services”.